Quicken vs Money Manager Ex

Compare features, pricing, and capabilities to find which solution is best for your needs.

Quicken

Quicken is a comprehensive personal finance management software designed to help individuals manage their money, track spending, create budgets, and monitor investments. It provides a holistic view of your financial life, integrating various accounts and transactions. by Intuit

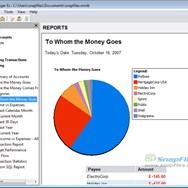

Money Manager Ex

Money Manager Ex (MMEX) is a free, open-source, cross-platform personal finance software designed for easy money management. It offers tools for budgeting, expense tracking, and financial reporting across various accounts, suitable for beginners and those seeking a straightforward approach. by CodeLathe

Comparison Summary

Quicken and Money Manager Ex are both powerful solutions in their space. Quicken offers quicken is a comprehensive personal finance management software designed to help individuals manage their money, track spending, create budgets, and monitor investments. it provides a holistic view of your financial life, integrating various accounts and transactions., while Money Manager Ex provides money manager ex (mmex) is a free, open-source, cross-platform personal finance software designed for easy money management. it offers tools for budgeting, expense tracking, and financial reporting across various accounts, suitable for beginners and those seeking a straightforward approach.. Compare their features and pricing to find the best match for your needs.

Pros & Cons Comparison

Quicken

Analysis & Comparison

Advantages

Limitations

Money Manager Ex

Analysis & Comparison

Advantages

Limitations

Compare with Others

Explore more comparisons and alternatives